How to Set Up Cash App: A Comprehensive Guide for 2025

In the rapidly evolving world of digital payments, knowing how to set up Cash App effectively is essential for seamless transactions. With features constantly being updated, this guide will provide you with the latest information on ensuring your Cash App setup is quick, efficient, and tailored to your needs in 2025. Let’s delve into the Cash App installation steps and navigate the various functionalities that will empower you to take charge of your financial interactions.

Understanding Cash App Features

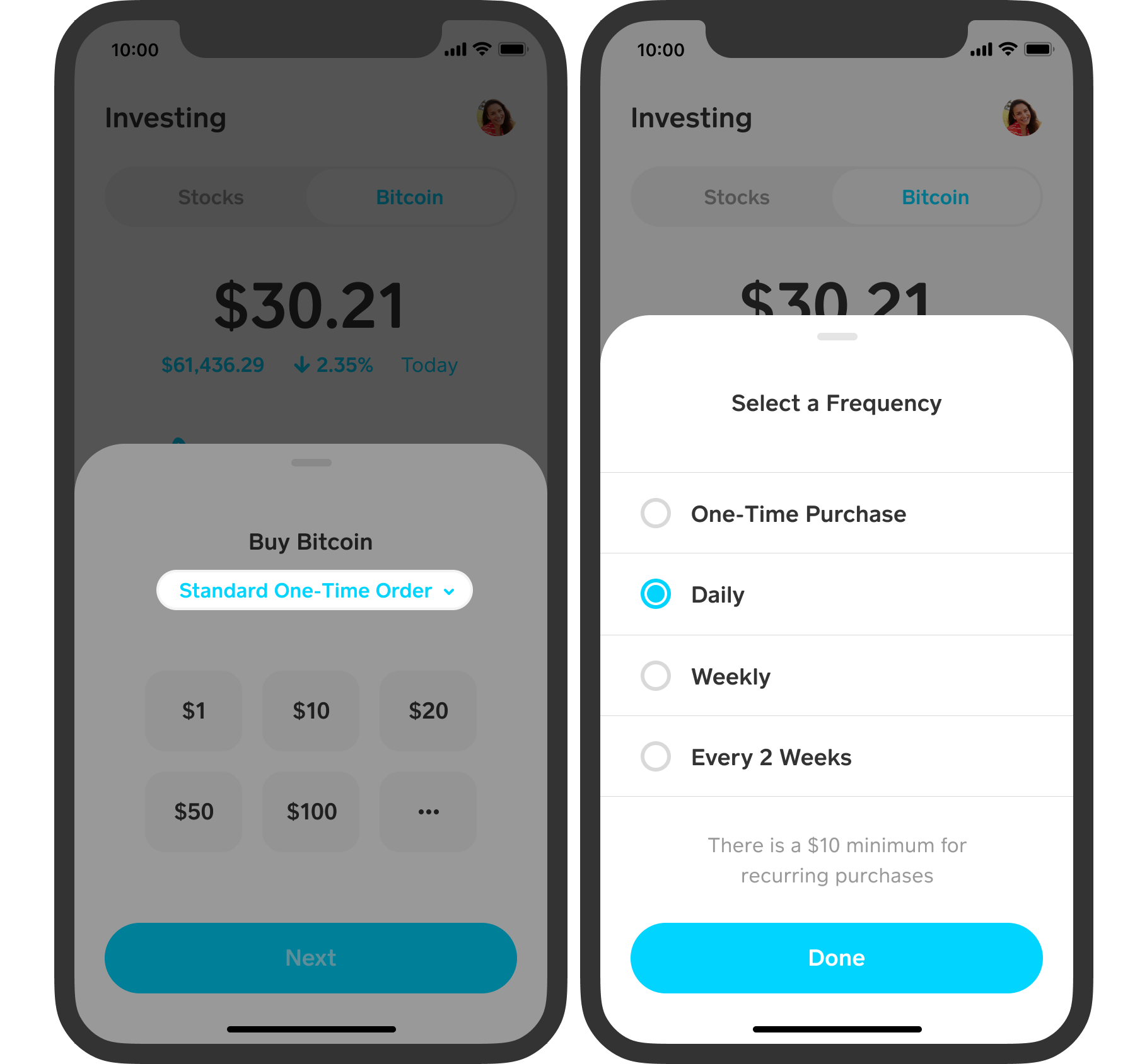

Before diving into the Cash App registration process, it is crucial to familiarize yourself with the plethora of Cash App features available. Cash App acts as a mobile wallet, enabling users to send and receive money quickly, purchase financial services, and even trade cryptocurrencies. These features include payment requests, cash cards, and enhanced security measures. Knowing what the app offers can drastically enhance your user experience.

Mobile Wallet Capabilities

The Cash App mobile wallet is at the heart of its functionality. Users can easily manage their funds, make transfers to and from bank accounts, and track their transaction history. Features such as Cash App payment setup streamline money transfers, allowing individuals to send money with just a few taps on their smartphones. For instance, if a friend owes you money for a dinner outing, you can send a request directly through the app, making exchanges simpler and prompt.

Cash Card Benefits

One of the standout features of Cash App is its Cash Card, a free debit card linked to your Cash App balance. This card enables users to make purchases at a wide array of retailers and even makes ATM withdrawals. To expand your Cash App experience, consider using the card for expenses, thus simplifying your budgeting process. For new users, setting up your Cash Card only requires following a few easy steps once your Cash App account is created.

Enhanced Security Measures

When dealing with financial transactions, security is paramount. Cash App offers a variety of security features, including encryption and two-factor authentication, which users can configure during their Cash App verification steps. Ensuring these features are in place helps protect your Cash App user account from unauthorized access, providing peace of mind as you navigate your daily transactions. Being vigilant about security protocols establishes a safer environment for managing funds.

Step-by-Step Cash App Setup Guide

Now that you understand the features, let’s walk through a straightforward Cash App setup guide to get you started. This process includes downloading the app, creating your account, and linking a bank account—all vital steps for fully utilizing Cash App’s potential.

Downloading Cash App

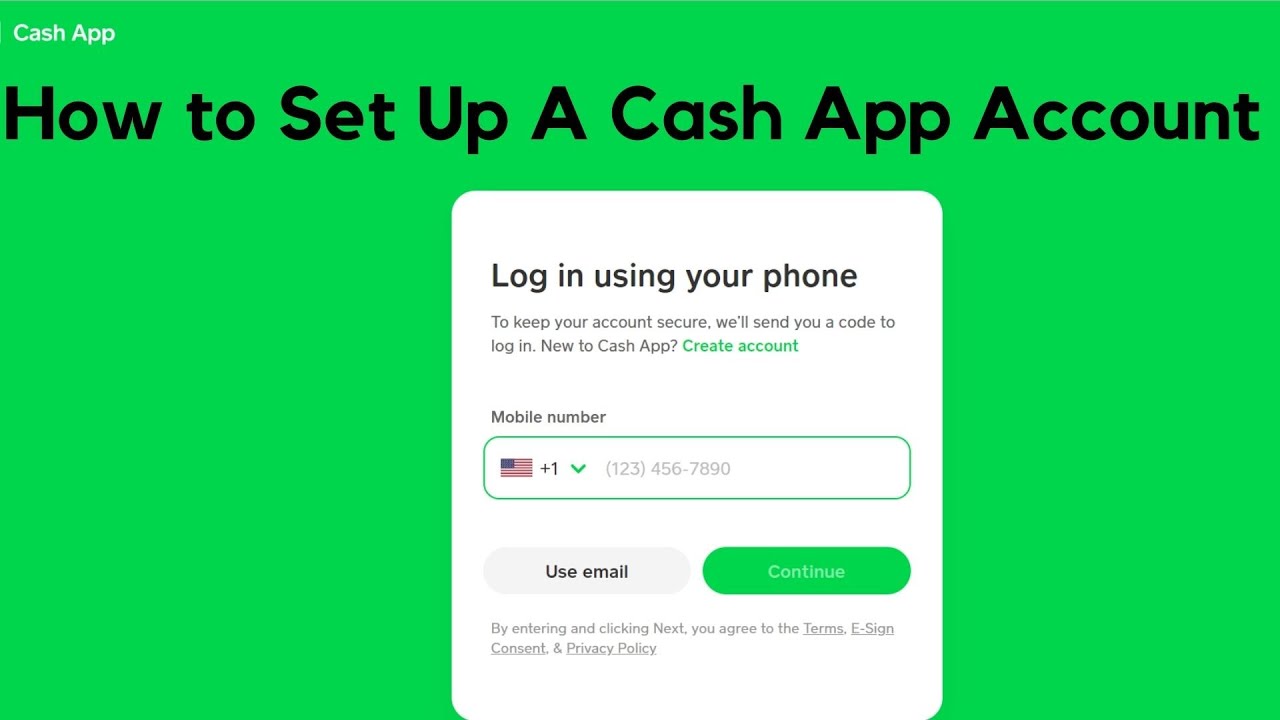

The first step in your cash app setup is to download the app. It’s available on both iOS and Android devices. Simply go to your respective app store, search for “Cash App,” and click the cash app app download option to initiate the installation. Once downloaded, open the app to begin the registration process.

Creating Your Cash App Account

After installing the app, the next step is the create Cash App account phase. You will be prompted to enter your phone number or email address, which will be used for verification. Following that, Cash App will send you a verification code to confirm your identity. This is crucial for ensuring that your account remains secure.

Linking Your Bank Account

Linking a bank account is a pivotal feature for full cash app functionality. After creating your account, navigate to the “Banking” section in the app to initiate the Cash App bank link setup. By linking a debit card or bank account, you enhance your ability to send and receive payments quickly. If you’re unsure how to proceed, the app provides detailed instructions to assist you through the process.

Cash App Customized Settings

After completing the basic setup, customizing your Cash App profile settings will allow you to streamline your experience. Managing how notifications are received, adjusting privacy settings, and configuring security features will greatly enhance your ability to use Cash App confidently.

Adjusting Privacy Settings

Controlling your Cash App privacy settings is critical for managing your financial information. Within your account, you can choose who can see your transactions and what information is publicly available. Limiting exposure is recommended for those using Cash App regularly, ensuring personal data remains protected while still allowing necessary transactions to occur seamlessly.

Enabling Notifications Setup

Keeping up with transactions is essential, so ensure you enable notifications relevant to your spending habits. This feature can be configured in settings under cash app notifications setup, allowing you to receive alerts whenever transactions are performed, payments are requested or received, and even updates about promotional offers. Staying informed helps in managing your funds effectively.

Setting Up Customer Support Access

When using any financial tool, having easy access to support is necessary. Familiarize yourself with the Cash App customer support features. Make note of the general help links provided within the app for troubleshooting and common issues. Should complications arise, having the appropriate resources prepared can substantially reduce frustration and maintain a seamless experience.

Maximizing Cash App Benefits

With your Cash App ready and optimized, you can now make the most of its features—both personally and professionally. Let’s explore tips for integrating Cash App into your daily financial habits, showcasing its convenience and versatility as a cash app mobile wallet.

Managing Transactions Effectively

To streamline your finances using Cash App, consider regularly checking your Cash App transaction history. Not only does this help in budgeting, but it also allows you to keep track of your spending patterns. For example, if you frequently transfer money, maintaining a log will give you insights into your cash flow and prompts when reallocations might be necessary.

Utilizing Advanced Features

To further enhance your experience, explore Cash App’s advanced features like Cash App order cash card options or participating in their rewards program. These additional integrations can yield potential savings and benefits, establishing Cash App as not just a payment tool but an essential financial partner. For example, cashback incentives make every purchase a chance to earn back money, which enhances overall user satisfaction.

Sharing Cash App with Friends

For those recommending Cash App to peers, consider Promoting its features through the Cash App referral program. By sharing your unique referral link, you can earn bonuses when your friends join and engage with Cash App. These referrals can amplify your savings, while also contributing to a tight-knit community around effective financial management.

Key Takeaways

- Cash App simplifies personal finance through easy money transfers and banking features.

- Understanding its features is essential to maximizing user experience—be sure to explore notifications and security settings.

- Monitoring your transaction history aids in recognizing spending habits and managing finances effectively.

- Utilize referral and rewards programs to enhance your engagement with the app.

- Having access to customer support resources ensures you are never alone when navigating challenges.

FAQ

1. What should I do if I forget my Cash App password?

If you forget your Cash App password, you can easily reset it using your email associated with your account. Simply click on the “Forgot Password?” link on the login page, and follow the prompts to reset your password securely. Keep in mind to use strong passwords for enhanced cash app security setup.

2. Can I use Cash App internationally?

At present, Cash App is only available in the United States and the UK. You won’t be able to utilize it for international transactions or money transfers from international accounts. However, you may check for future updates concerning Cash App international transactions should they become available.

3. How can I withdraw cash using Cash App?

To withdraw cash using your Cash App Cash Card, simply locate an ATM, insert your card, and follow the on-screen instructions. Be aware that optional ATM withdrawal fees may apply, so it’s beneficial to familiarize yourself with the potential cash app withdrawal fees linked to various ATMs.

4. What should I do if I experience issues with Cash App?

If you encounter any problems while using Cash App, refer to the cash app troubleshooting section within the app. It offers guides on common issues since users frequently report similar problems. If further assistance is necessary, reach out to Cash App customer support for help.

5. How do I activate my Cash Card?

To activate your Cash Card, open the Cash App, navigate to the Cash Card section, and then select the activation option by following the prompts. It is a straight-forward process, allowing you to start using your card for purchases and withdrawals almost immediately.

Taking these steps will ensure you can utilize Cash App to its fullest potential, while also enabling a secure and rewarding financial experience, enhancing your management of funds for 2025 and beyond.