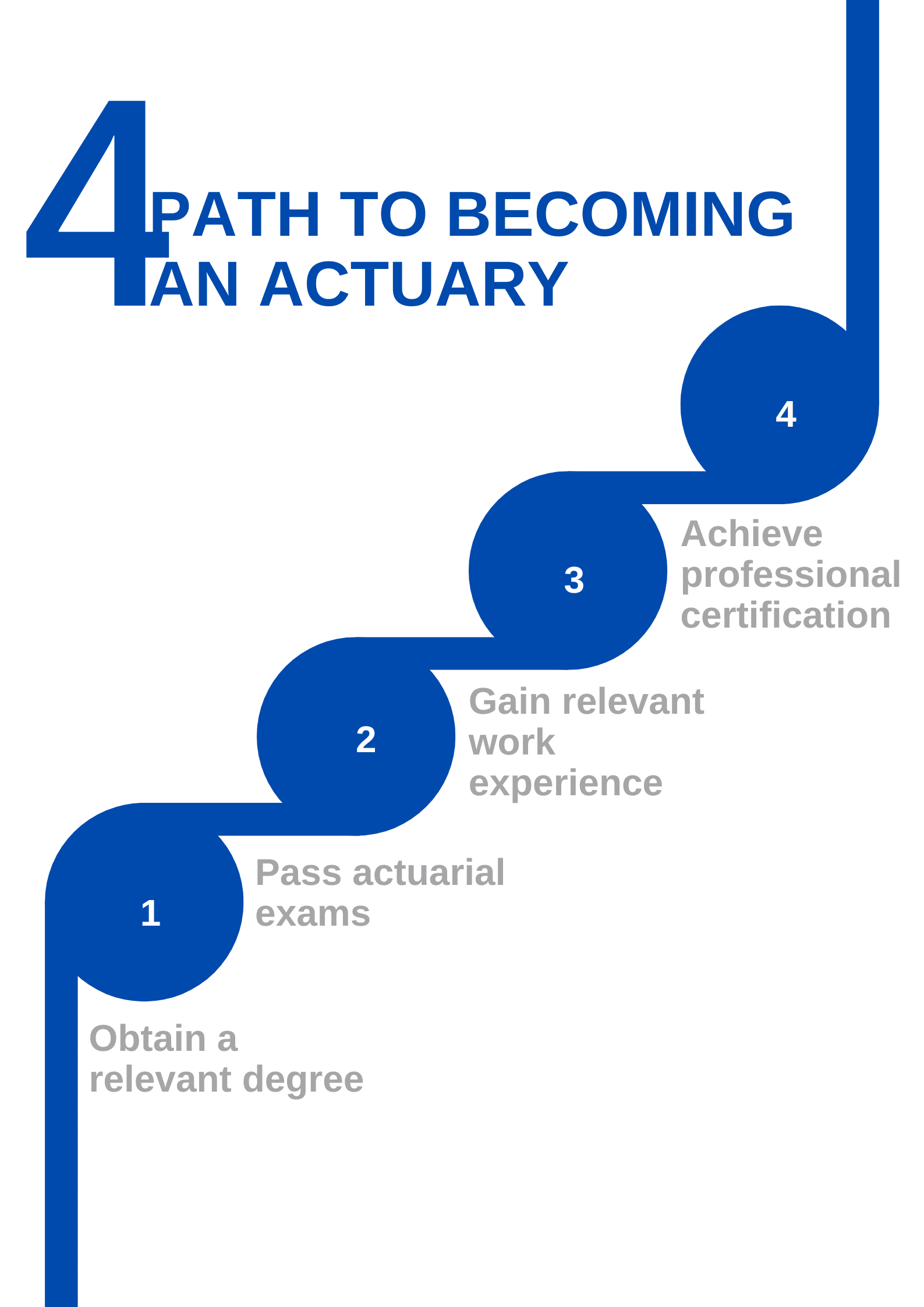

How to Start Your Journey to Become an Actuary: Essential Steps for Success in 2025

The journey to an actuary career is a rewarding but challenging path that requires dedication, comprehensive knowledge, and strategic planning. As we approach 2025, understanding the steps needed to become an actuary is crucial for aspiring professionals. This article will explore significant milestones on your actuarial journey, from obtaining an actuarial degree to mastering essential skills and passing required actuarial exams.

The Foundation of Becoming an Actuary: Educational Requirements

To begin your path to becoming an actuary, you need a solid educational background in quantitative fields. Most actuaries hold an actuarial degree or a degree in mathematics, statistics, finance, or economics. Universities often offer specialized actuarial programs that provide the theoretical knowledge and practical skills essential in this profession. Further, consider enrolling in online actuarial courses to enhance your flexibility. Individualized study techniques, such as creating actuarial study groups, can also improve your understanding of materials and increase your chances of success in actuarial exams.

Focus on Actuarial Science

One crucial component of your education is a strong foundation in actuarial science. This interdisciplinary field combines mathematics, statistics, and financial theory to analyze the financial implications of risk and uncertainty. Familiarity with concepts such as financial mathematics, risk assessment, and statistical modeling enables you to build the analytical framework necessary for effective decision-making. As you progress, engaging in internship opportunities can provide practical experience and improved competency in data analysis for actuaries.

Choosing the Right Actuarial Degree Program

When selecting a suitable program for your actuarial education, consider what top universities offer the strongest actuarial internships and their connections with famous actuarial organizations. Such affiliations can help you create a professional network and uncover job opportunities in prestigious actuarial consulting firms. It’s also worth exploring schools that offer mentorship programs, as guidance from experienced actuaries can provide valuable insights into the profession.

Understanding the Actuarial Exams

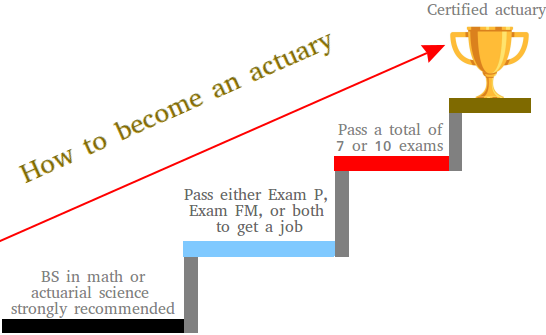

The path to becoming an actuary is heavily influenced by the success rates of actuarial exams. These exams assess your knowledge in core areas such as probability, financial mathematics, and risk management strategies. Many candidates often struggle with the rigorous exam process, so developing a solid study routine and utilizing resources such as exam passing rates statistics can enhance your preparation. Adopting study techniques for actuarial exams that focus on practical applications of learned concepts will be particularly beneficial.

Skills Needed for Actuaries: Building a Competency Framework

To attain a successful actuarial career, it’s essential to hone a diverse skill set. Beyond quantitative skills, you’ll need strong problem-solving skills, analytical thinking, and effective communication. Actuaries must analyze data and communicate complex findings to non-technical stakeholders, requiring competency in both verbal and written communication. Moreover, strong time management skills are crucial, as the demands of preparing for numerous examinations can quickly escalate if not managed properly.

Soft Skills for Success

A buoyant career in actuarial science demands a balance of technical know-how and interpersonal skills. Soft skills such as teamwork in actuarial work, leadership in actuarial field, and emotional intelligence in actuary roles enhance your ability to function optimally in various settings. Displaying these abilities will give you a significant advantage when pursuing roles in actuarial jobs or transitioning to actuarial analyst roles. Furthermore, integrating soft skill development alongside technical training can create a well-rounded platform for your future.

Developing Technical Proficiency

As technology integrates more into the actuarial field, ensuring you are well-versed in actuarial software is paramount. Familiarity with data visualization techniques and financial analysis techniques enables actuaries to create compelling presentations and actionable insights for their clients. Additionally, exposure to programming for actuaries, particularly languages like R or Python, can streamline your workflows and provide an edge in project management for actuaries. Strengthening your technical proficiency alike will lay the groundwork for comprehensive actuarial models and forecasts.

Networking and Professional Development

Establishing a robust professional network is vital for aspiring actuaries. Engaging in forums and professional networking sites dedicated to actuaries aids in **gaining insights into actuaries work and building relationships with industry peers. Attending career fairs and industry events provides opportunities to connect with actuarial organizations and industry leaders. Continuous education for actuaries through specialized leadership development programs or professional development courses will allow you to stay relevant in the ever-evolving landscape of the actuarial profession.

Exploring Job Opportunities and Advancement in Actuarial Careers

The actuarial job market is filled with varied roles, ranging from health insurance actuaries to pension planning specialists. Continuous growth and transformation within industries result in job opportunities for actuaries that evolve along with society’s emerging needs. Recognizing the trends in actuarial science, securing internships for actuaries, and seeking out entry-level positions can pave the road to career advancement.

Actuarial Roles and Responsibilities

Actuaries engage in diverse work settings, taking on roles that encompass investment analysis, risk management strategies, and compliance in actuarial work for financial products. Each position involves analyzing numerical data to create statistical models that mitigate risk and influence future behaviors. Understanding your preferences for specific work environments—ranging from corporate finance to healthcare data modeling—can better align your career aspirations with reality, enhancing both job satisfaction and performance.

Job Outlook for Actuaries

The job outlook for actuaries is promising, primarily due to the growing need for risk management and evaluation in an increasingly complex economic landscape. Actuaries play an essential role in advising clients on risk, which will always be in high demand. As insurance markets and financial systems evolve, professionals with expertise in economic forecasting and actuarial risk management will find a wealth of employment and career advancement opportunities well into the future.

Advancing Your Actuarial Career

Career advancement for actuaries often hinges on obtaining professional designation. Most actuaries pursue certification through recognized bodies, increasing their credibility and job market competitiveness. In addition to displaying strong technical skills, aspiring actuaries should cultivate relationships with mentors in the field and participate in professional organizations. Regularly attending actuarial career fairs and seeking resources for actuarial students can also aid in shaping your career path for long-term success.

Key Takeaways

- Obtain a strong education in an actuarial field, focusing on relevant degree programs.

- Develop both technical and soft skills to excel in communication and problem-solving.

- Engage in networking opportunities to foster professional connections and mentorship.

- Understand job market trends for actuaries to explore a wide range of career opportunities.

- Pursue continuous education and professional certifications for long-term career advancement.

FAQ

1. What is an actuary’s primary role?

An actuary analyzes financial risk using sophisticated statistical methods and mathematical modeling. They primarily work within insurance companies, pension plans, and financial institutions to advise on risk management strategies and financial forecasts. Their strong background in data analysis for actuaries enables them to deliver insights regarding long-term profitability.

2. How long does it typically take to become a certified actuary?

The journey towards becoming a certified actuary can take several years, depending on the actuarial exams passing rates and the number of prerequisites each individual has completed. Generally, it requires passing between five to ten exams over a period of 4 to 7 years, alongside obtaining relevant work experience and possible internships for actuaries.

3. What are the different types of salaries actuaries can expect?

Actuarial salary varies widely based on experience, specialization, and job location. Entry-level actuaries typically earn between $60,000 and $80,000 annually, while experienced professionals can earn upwards of $150,000. Specializations in areas such as health insurance actuaries or finance-related sectors can significantly influence salary ranges.

4. Are there online resources for study materials for actuaries?

Yes, various online platforms offer excellent materials for actuarial exams preparation, including books, video lectures, and practice problems. Websites dedicated to actuaries often provide access to community study groups that foster collaboration and knowledge exchange among aspiring professionals.

5. What is the importance of networking in the actuarial profession?

Networking for actuaries is crucial as it continuously opens doors to job opportunities, mentorship, and professional development. Engaging with other professionals in the field aids in staying up to date with industry changes and increases the potential for career advancement.

6. What are the potential challenges one might face while preparing for actuarial exams?

Challenges when preparing for actuarial exams often include balancing study with personal commitments, access to quality study resources, and the pressure associated with high-stakes testing. Developing an effective time management plan can help mitigate these challenges, fostering a more proactive study approach.

7. Are there specialized actuarial consulting firms available for recent graduates?

Yes, many highly-regarded actuarial consulting firms actively seek recent graduates for entry-level positions. These firms offer extensive training and mentorship programs designed to transition new hires into experienced actuarial roles while providing invaluable exposure to various projects and clients in the industry.