How to Calculate Revenue: Smart Ways to Optimize Your Strategy in 2025

As every business owner knows, **how to calculate revenue** effectively can make or break financial success. In 2025, accurate revenue calculation is more critical than ever, as companies strive for higher profitability amid fluctuating market dynamics. This article delves into proven **revenue calculation methods** and innovative strategies, offering actionable insights to enhance your business’s financial health. Understanding revenue is key to unlocking your business’s potential, and adopting best practices ensures that you remain competitively viable.

The Fundamentals of Revenue Calculation

To master **revenue calculation**, one must first understand the foundational principles that underpin this vital process. An introduction to the **revenue calculation formula** helps demystify the complexities of effectively assessing income streams, such as total sales minus returns or discounts. Commonly, businesses can utilize both gross revenue and net revenue definitions to develop a comprehensive outlook on profitability. With clarity around revenue metrics, stakeholders can make informed decisions that positively impact their financial strategies.

Understanding Different Revenue Components

In the landscape of **business revenue analysis**, recognizing different types of revenue is crucial. Businesses typically deal with recurring revenue from subscriptions, transactional income from sales, and one-time revenue from special projects. Managing these streams involves **revenue cycle management**, which secures an organization’s cash flow and sustains value. By knowing how to calculate revenue per project, these revenue streams can be differentiated, enabling more accurate forecasting and enabling better **revenue growth strategies**.

Revenue Recognition Principles

**Revenue recognition principles** guide businesses on when and how to record revenue in financial statements, impacting profitability and compliance. Understanding these principles assists in navigating **revenue reporting** standards and reflects more accurately on actual business performance. Adopting revenue recognition best practices not only ensures company loyalty but also satisfies regulatory scrutiny while maintaining transparency with investors during **revenue impact assessment**.

Revenue Metrics: Evaluating Performance

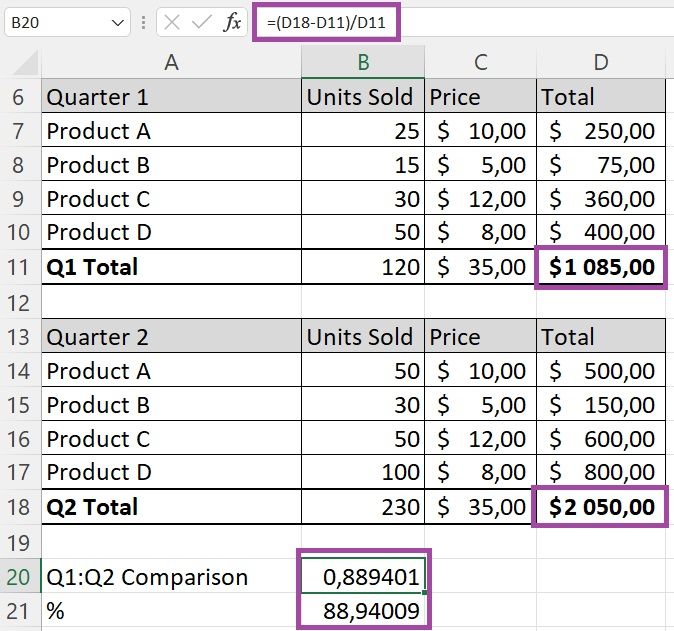

Tracking **key revenue metrics**, like **revenue growth rate** and **revenue performance indicators**, offers insights into business health. Effective evaluation of these metrics helps companies gauge financial performance over time and identify trends that require attention or alteration in strategy.by leveraging sophisticated **revenue analysis tools**, businesses can quickly prepare reports highlighting **revenue growth challenges** while adjusting strategies for improved **revenue optimization**.

Innovative Methods for Maximizing Revenue

To achieve impressive growth, businesses must explore innovative **revenue optimization tips**. These strategies highlight opportunities in areas such as pricing, service delivery, and customer experience to maximize earnings. Learning how to develop efficient **revenue projections** is key to unlocking potential revenue channels, allowing companies to identify growth opportunities and align their efforts in goal-setting effectively. Continued innovation can be the drive behind successful **revenue generation strategies** like dynamic pricing and value-based models.

Revenue Forecasting Techniques

Adopting appropriate **revenue forecasting techniques** involves analyzing historical data to project future trends efficiently. For example, employing data-driven practices can enhance forecasts by implementing tools that rely on data analytics and market simulations. Utilizing these techniques is especially beneficial for identifying and mitigating **revenue leakage**, which can severely hinder business growth. An informed approach equips businesses with insights necessary for budgeting and securing funding for expansion initiatives.

Implementing Revenue Diversification Strategies

Diversification is paramount for minimizing risk and maximizing **revenue potential**. Companies can adopt **revenue diversification strategies** by exploring new markets, introducing new products or services, or expanding their geographical reach. This adaptability promotes resilience in times of economic uncertainty and can significantly improve the bottom line by expanding customer bases and creating additional income streams through critical revenue sources identification.

Utilizing Revenue Insights for Strategic Decisions

Successful businesses utilize **revenue insights generation** and analytics to inform crucial financial decisions. Through an understanding of **revenue dynamics analysis**, organizations can forecast potential business scenarios and adjust strategies for **revenue improvement** accordingly. Achieving actionable insights inspires confidence in decision-making and encourages continuous revenue generation while refining current business methodologies.

The Future of Revenue Management

As we look towards 2025, mastering the principles of **revenue management** will define successful organizations adapt to market fluctuations and consumer behavior shifts. This involves leveraging technology for **revenue performance management**, utilizing dashboards, and incorporating automated reporting to achieve maximum efficiency. Additionally, aligning **revenue goals setting** with broader business objectives ensures strategic coherence across all levels.

Forecasting Business Revenue: Steps to Success

To effectively forecast business revenue, companies should follow a structured approach. Begin by gathering historical data on sales and revenue to establish baseline figures. Next, utilize predictive analytics to identify patterns, allowing you to adjust **revenue benchmarks** based on anticipated changes in market conditions. Finally, rely on established models and tools throughout this process—adopting a comprehensive revenue mapping technique to visualize **revenue and profit relationships** will enhance clarity and promote informed predictions.

Revenue Reporting and Compliance

Establishing strong **revenue reporting** mechanisms is essential for compliance and long-term growth. Regular performance reviews through detailed **revenue analysis reports** help companies stay accountable to stakeholders and satisfy regulatory requirements. New technologies like real-time data reporting can significantly enhance the accuracy and relevance of these assessments, ensuring proactive identification of any emerging issues.

Strengthening Revenue Collection Processes

Effectively managing **revenue collection processes** should include implementing robust invoicing solutions, tracking payments, and maintaining comprehensive records. Consistently applying these methods not only optimizes cash flow but also mitigates the risk of revenue loss. Focusing on streamlining collection processes will lead to improved customer relationships and minimized exposure to revenue-related issues.

Key Takeaways

- Implement foundational revenue calculation methods to enhance financial accuracy.

- Emphasize diversification and innovative strategies for maximizing revenue potential.

- Utilize advanced forecasting techniques to create data-driven projections.

- Consolidate revenue goals with organizational objectives for coherent strategy implementation.

- Strengthen revenue collection processes to optimize cash flow and ensure business stability.

FAQ

1. What is the difference between gross revenue and net revenue?

**Gross revenue** refers to the total income generated before deductions, while **net revenue** is the profit left after subtracting discounts, returns, and operational costs. Understanding both types of revenue is essential for accurate financial reporting and effective **revenue metrics evaluation**.

2. How are revenue goals set within an organization?

Setting **revenue goals** entails analyzing past performance and market conditions, aligning with company objectives, and utilizing factors like profitability and growth to formulate achievable targets. Organizations often consider performance indicators and industry benchmarks in this process.

3. What are common challenges in revenue growth?

Common **revenue growth challenges** include fluctuating market demand, increased competition, and economic downturns. Businesses must be agile and adaptive in their strategies to maintain revenue growth in such circumstances, employing research and data analytics to stay ahead.

4. How can companies prevent revenue leakage?

Preventing **revenue leakage** involves continuously monitoring processes, establishing stringent compliance checks, maintaining accurate records, and leveraging technology for effective oversight. Companies must actively look for discrepancies and gaps in their revenue processes to sustain profitability.

5. What tools are available for revenue performance management?

Numerous tools exist for **revenue performance management**, including analytics dashboards, forecasting software, and revenue recognition platforms. These tools assess trends, track key performance indicators, and provide data visualization to help organizations enhance their financial decision-making processes.

6. Why is understanding revenue streams essential?

Grasping diverse **revenue streams** is essential for a comprehensive business strategy; it enables companies to evaluate how each contributes to overall profitability. Understanding these dynamics aids in making informed decisions regarding where to focus resource allocation and growth efforts.

7. What role does technology play in revenue forecasting?

Technology plays a crucial role in **revenue forecasting** by providing sophisticated tools that allow organizations to analyze vast amounts of data quickly. This efficiency leads to more accurate projections and enables businesses to adapt strategies based on real-time insights.