Effective Guide to How to Send Money on Cash App in 2025

In today’s digital age, sending money quickly and securely is more important than ever. **Cash App** has become a popular choice for peer-to-peer money transfers, offering users a convenient platform to manage their finances. In this comprehensive guide, we will explore how to send money on Cash App effectively in 2025, discussing various features while providing tips to enhance your user experience. Let’s dive into the **Cash App money transfer** process.

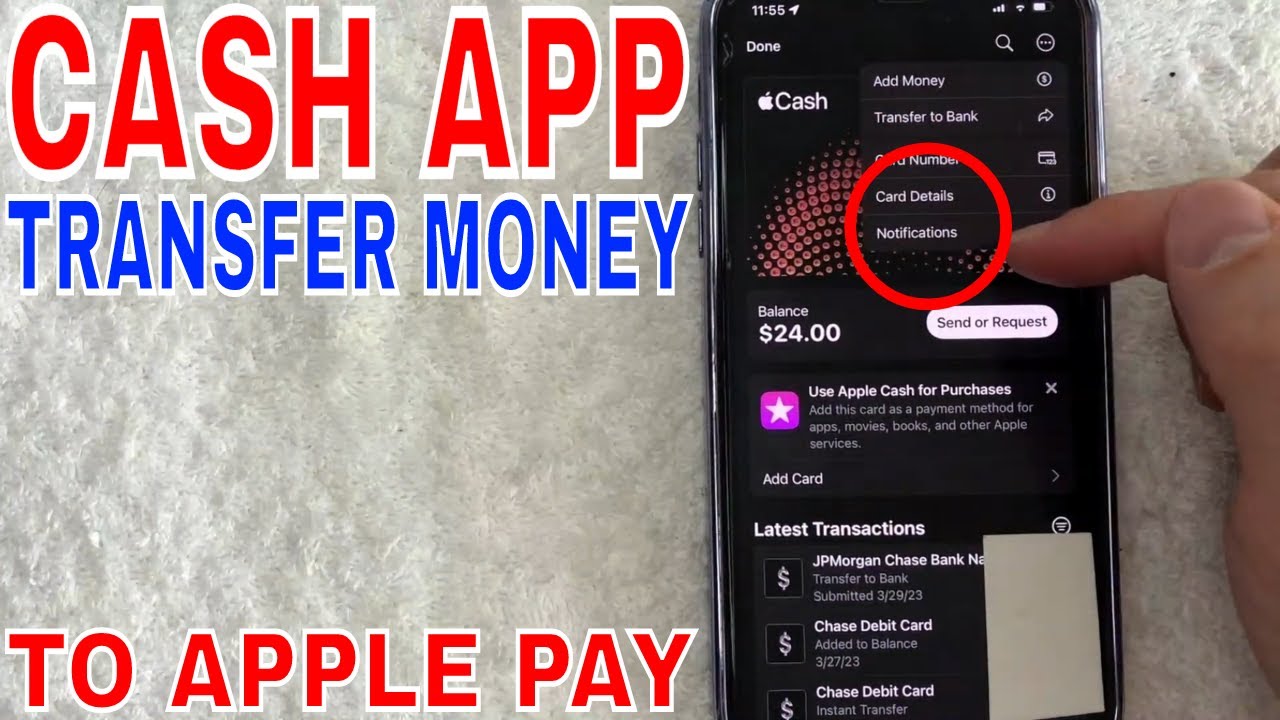

Understanding the Cash App Payment Process

Before you can send money on Cash App, it’s crucial to understand the **Cash App payment process**. This involves linking your bank account to the app, setting up your Cash App profile, and through a few simple steps, you can initiate a transfer. The **Cash App setup for sending money** is user-friendly, allowing for quick transactions whether you’re sending cash to a friend or paying for a service.

Linking Your Bank Account to Cash App

To begin using Cash App, you first need to **link your bank account**. Open the app and navigate to the settings, where you can find the option to add your bank details. This step is vital as it facilitates Instant Transfers and cash withdrawals from your Cash App balance. Cash App allows you to connect to various bank accounts and debit cards, making the **Cash App to bank transfer** seamless and efficient. Make sure to use a bank offering instant verification to speed up the setup process. Paying attention to the **Cash App transaction limits** is also essential during this stage to ensure smooth transfers.

Creating a Cash App Profile

Your Cash App profile is another critical aspect of using the service efficiently. To begin, simply create an account using your email or phone number, choosing a unique username known as a **$Cashtag**. This unique identifier streamlines the **Cash App send money** process as it allows others to send you funds easily. Also, authenticating your account via email or phone number adds an extra layer of security. With a well-set profile, you are one step closer to using **Cash App** for quick payments.

Initiating the Money Transfer

Once your bank account is connected and your profile is set up, you are ready to proceed with the **Cash App transactions**. To initiate a transaction, simply enter the recipient’s **$Cashtag**, amount to send, and a short note if desired. Be mindful of **sending funds via Cash App** within the transaction limits, as exceeding these limits may require further verification. It’s essential to check your balance or make sure your linked bank account has sufficient funds to complete the transfer smoothly. Also, consider enabling **Cash App security features** to protect your financial information during transactions.

Exploring Cash App’s Fast Solutions for Sending Money

One of the standout features of **Cash App** is its capacity for instant money transfers. Understanding how to utilize these options can significantly enhance the efficiency of the **money sending app** experience.

Instant Transfer Options

When needing **instant transfer Cash App** services, users can choose between Standard and Instant transfer options. Standard transfers are free but may take 1-3 business days, whereas Instant transfers incur a nominal fee, allowing funds to arrive in your bank account almost immediately. This feature is particularly beneficial for emergencies or time-sensitive transactions. Familiarizing yourself with the **Cash App payment options** helps ensure you pick what’s best for your needs at any given moment.

Using Cash App for Peer-to-Peer Payments

Peer-to-peer payments constitute one of the primary functions of **Cash App**. It bridges the gap between individuals wanting to send or receive money seamlessly. In 2025, leveraging this feature can assist you in quickly settling bills with friends or sharing costs for group outings. The user-friendly interface and straightforward instructions enable anyone to use **Cash App effectively** for payments, instilling trust in the process of **sending money to friends**.

Best Practices for Using Cash App for Payments

To maximize your **Cash App money features**, consider the following best practices: regularly update your app to access new features, always verify recipient details before sending funds, and utilize two-factor authentication for added security. Being aware of **Cash App support** options ensures users can find resolutions quickly and effectively in case of issues. Furthermore, familiarize yourself with **Cash App updates and changes** to maintain a smooth usage experience.

Managing Your Cash App Account Efficiently

Efficient management of your **Cash App account** is essential to optimizing the service and tracking your financial activities. This section breaks down vital aspects of account management and highlights useful tips.

Reviewing Transaction History on Cash App

Regularly checking your **Cash App transaction history** serves not only as a security measure but also helps in budgeting efforts. Users can review their activity within the app to catch any suspicious transactions or simply to keep tabs on their spending patterns. Summary reports can be generated for easy comprehension, helping users utilize their funds effectively within the **Cash App money transfer** context.

Using Cash App’s Cash Management Features

Cash App offers users unique **cash management** features such as sending and receiving money online or transferring money directly to a bank account. Familiarizing yourself with nuances like shared cash transfers can empower better financial control. Furthermore, the option for direct deposits into your Cash App account streamlines budget management by automating income flow. Be sure to also utilize the **Cash App FAQ** for questions regarding account setups to ensure you are using the app effectively.

Withdrawing Money from Cash App

Whether you are analyzing your spending or budgeting for upcoming expenses, knowing **how to withdraw money Cash App** is crucial. Users can easily transfer funds back to their linked bank accounts with a few taps. Encourage frequent checks on pending withdrawals to stay apprised of your available balance and avoid any inconveniences associated with account limits. Additionally, remaining vigilant about withdrawal limits ensures you remain in control when managing **Cash App transactions**.

Key Takeaways and Conclusion

As digital payments continue to advance, learning how to send money on Cash App becomes an invaluable skill in 2025. Through understanding the **Cash App money features** and keeping abreast of security practices, users can enjoy a secure and efficient way of executing financial transactions. Always remember to stay informed about updates, practice good account management, and utilize the available features to your advantage.

FAQ

1. How can I ensure secure payments using Cash App?

To **secure payments Cash App**, enable two-factor authentication in your account settings, avoid sharing your **$Cashtag**, and regularly update your password. Additionally, familiarize yourself with the app’s **Cash App security** guidelines to stay protected from scams and fraudulent activities.

2. What is the difference between Standard and Instant Transfer on Cash App?

Standard transfers typically take 1-3 business days and are free of charge, while Instant transfers require a small fee and deliver funds within minutes. Choosing between these options depends on how urgently you need your funds deposited.

3. Can I send money internationally using Cash App?

As of now, Cash App does not support sending money internationally. It’s tailored for U.S. operations, so for **sending money internationally Cash App**, users might need alternatives like PayPal or TransferWise to facilitate their transactions.

4. How can I check my Cash App balance?

To check your balance, simply open the Cash App and look at the home screen where your balance amount is displayed prominently. For a breakdown of your transactions, navigate to the “Activity” tab for further auditing.

5. What should I do if I encounter issues using Cash App?

If you face any issues while using Cash App, first consult the **Cash App support** section within the app. It provides troubleshooting tips and comprehensive guides. Additionally, you may contact **Cash App customer service** for personalized assistance.